Full Year Highlights

(Figures in brackets are for the twelve months ended December 31, 2011)

- Order backlog grew by 21% year-on-year to RUB 21.5 billion and was driven by continued steady demand for pumps, equipment and EPC services for infrastructure projects

- Revenues up 22.4% year-on-year to RUB 33.7 billion (RUB 27.5 billion)

- Adjusted EBITDAEBITDA is defined as operating profit/loss adjusted for other income/expenses, depreciation and amortization, impairment of assets, provision for obsolete inventory, provision for impairment of accounts receivable, unused vacation allowance, defined benefits scheme expense, warranty provision, provision for legal claims, provision for VAT and other taxes receivable, other provisions, excess of fair value of net assets acquired over the cost of acquisition. This measurement basis excludes the effects of non-recurring income and expenses on the results of the operating segments. up 13.1% year-on-year to RUB 6.2 billion (RUB 5.5 billion), with an adjusted EBITDA margin of 18.5% versus 20% in the previous year

- Profit for the year contracted by 31.8% to RUB 2.3 billion from RUB 3.4 billion

- Total debt grew by 109.3% from RUB 6.4 billion to RUB 13.4 billion

- Net debt grew by 150.8% to RUB 12.1 billion as of December 31, 2012 (RUB 4.8 billion)

Key Developments in 2012

- Several landmark projects in Russia have been successfully completed. Among them was the delivery of trunk line pump systems to the East Siberia — Pacific Ocean (ESPO) pipeline by Transneft. The project has strategic importance for the country’s oil industry infrastructure and features a total pipeline length of more than 4,100 km.

- Another flagship project completed in 2012 was the second stage of the Vankor oilfield development, where HMS provided an integrated solution on delivery of a broad range of equipment and commissioning of water processing units as part of a produced water treatment system which was previously designed by HMS. The Vankor oilfield was launched in 2009 and is now one of the largest high-quality oil suppliers to the ESPO pipeline.

- The Group secured several large infrastructure contracts across all business segments for different economic sectors, including:

- the follow-up contract for ESPO — production and delivery of 12 trunk pipeline pump units for 3 pump stations,

- projects for the production and delivery of specialist pumps for the nuclear industry in Russia and China,

- construction of 3 main water pumping stations located in Turkmenistan,

- the turn-key project for delivery and installation of a compressor station.

- Two acquisitions completed during 2012:

- Kazankompressormash (KKM), one of the leading manufacturers of centrifugal and screw compressors in Russia, located in Kazan, Tatarstan. HMS acquired 77.8% of voting shares (74.35% of share capital) for a total cash consideration of RUB 5.5 billion

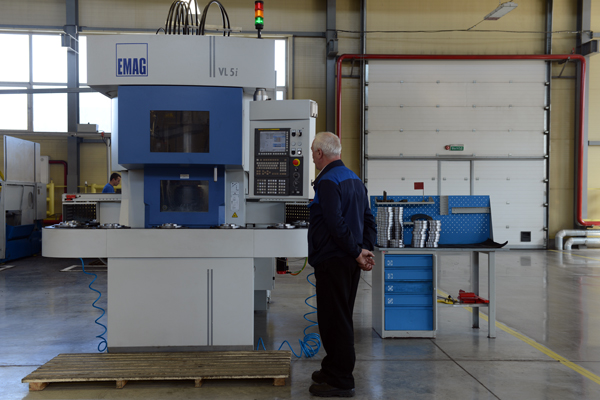

- Apollo Goessnitz (Apollo), a worldwide operating manufacturer of centrifugal pumps and system equipment, located in Goessnitz (Thuringia), Germany. HMS Group paid total cash of EUR 25 million for 75% of share capital of Apollo Goessnitz GmbH. The stake was acquired proportionally from the management, which remained the part of the integrated team.

R&D activities

- HMS Group was included in the short list of finalists of Pump Industry Awards, established by the British Pump Manufacturers’ Association. The Group was recognized finalist in the “Technical innovation of the year - Projects” nomination for its turnkey project of a pump station construction in Turkmenistan

- Automated multifunctional measuring and computing complex ACIS-6 was purchased for subsurface laboratory for analysis of subsoils

- Continued cooperation with Transneft under the project of ESPO 1 extension. A number of brand new large-capacity pumps of NM type for oil transfer were developed and successfully tested;

- Carried out a number of successful testing of oil trunk pumps based on double suction centrifugal pumps for another Transneft’s project — Purpe Samotlor oil pipeline construction;

- Developed technological modules based on improved injection pumps of ZNS type for Vankor oilfield by Rosneft, a principally new type of equipment that hasn’t been produced in Russia before;

- Continued expansion of research and development works for the oil and gas processing equipment, compressor and power generating units under a new design center based on HMS Neftemash facilities;

Operational improvements

- Ongoing implementation of unified IT infrastructure for accounting and reporting purposes, development of IT security system for the head office

- Ongoing development of a ERP project based on a software by Infor-LN integrated with PDM systems focused on capturing and maintaining information on products and services through its useful life, engineering and technological database, planning and coordinating all transactional operations for R&D support

* EBITDA is defined as operating profit/loss adjusted for other income/expenses, depreciation and amortization, impairment of assets, provision for obsolete inventory, provision for impairment of accounts receivable, unused vacation allowance, defined benefits scheme expense, warranty provision, provision for legal claims, provision for VAT and other taxes receivable, other provisions, excess of fair value of net assets acquired over the cost of acquisition. This measurement basis excludes the effects of non-recurring income and expenses on the results of the operating segments.