Operating Review

Financial Summary

| (Rub million) | FY 2012 | FY 2011 | Year-on-Year

Change |

|---|---|---|---|

| Order intake | 36,110 | 23,221 | 55.5% |

| Backlog | 21,513 | 17,777 | 21.0% |

| Revenue | 33,656 | 27,496 | 22.4% |

| Adjusted EBITDA | 6,231 | 5,509 | 13.1% |

| Operating profit | 4,237 | 4,547 | -6.8% |

| Profit for the period | 2,301 | 3,377 | -31.8% |

| Basic and diluted earnings per share (Rub per share) | 17.89 | 27.88 | n/a |

| ROCE (LTM)ROCE is calculated as EBIT (last twelve months) divided by average total debt plus average equity. | 18.7% | 36.2% | n/a |

Group

HMS Group’s consolidated revenues increased by 22.4% year-on-year for the full year in 2012, mainly driven by a gradual execution of the infrastructure projects implemented by main oil and gas majors. Strong activity in the oilfields development, oil transportation and water and energy markets in 2012 was a core driver of the revenue growth. During 2012 HMS executed the projects for the main oil and gas majors, including providing pump-based integrated solutions for Transneft in the midstream, delivery of oil and gas equipment and providing EPC works for Rosneft, TNK-BP, Surgutneftegaz, Lukoil and Gazpromneft, Taas-Yuriakh Neftegazodobycha, in the up- and downstream as well as in the gas processing for Gazprom and Novatek. The revenue growth in 2012 was mainly driven by strong performance in the oil and gas equipment and EPC business units, largely due to the large-scale projects with Rosneft and several large projects for engineering and construction services. The industrial pumps business unit accounted for approximately 50.7% of total Group’s consolidated revenue in 2012 versus 56.9% in 2011, oil and gas equipment business unit accounted for 23.2% compared to 21.5%, while EPC business unit share in revenue was flat and accounted for 21.7% in 2012 versus 21.6% in the previous year. Newly established in July 2012 business segment Compressors accounted for 4.2%.

Total order backlog reached Rub 21.5 billion driven by several large contracts secured during the first three quarters 2012. As a result the total backlog came 21.0% higher than RUB 17.8 billion in 2011, with stronger backlog diversification.

HMS Group’s cost of sales grew in line with the revenue and increased by 23.6% year-on-year to RUB 23,645 million in 2012 compared to RUB 19,131 million in 2011, mainly due costs growth driven by consolidation of the acquired companies.

Sales, general and administrative expenses increased by 45.1% year-on-year to RUB 5,217 million for the full year 2012 while its share in the total revenue accounted for 15.5%, up from 13.1% in the previous year.

The Group’s adjusted EBITDA increased by 13.1% year-on-year from RUB 5,509 million to RUB 6,231 million, driven by execution of several large-scale infrastructure contracts in oil upstream and oil transportation segments. The Group’s adjusted EBITDA margin was 18.5% in 2012, compared to 20.0% in 2011.

Due to the growth of other operating expenses largely driven by fines under contracts, social expenditures, provision for legal claims and expenses related to acquisitions, the Group’s EBIT contracted by 6.8% year-on-year in 2012. The EBIT margin stood at 12.6% in the reporting period from 16.5% in 2011.

Due to debt growth driven by acquisitions completed in 2012, interest expenses grew to Rub 1,220 mln, compared to Rub 486 mln, and comprised 3.6% of revenue versus 1.8% in the previous year. As a result, the Group’s profit for the year declined by 31.8% year-on-year and amounted to RUB 2,301 million in 2012 versus 3,377 million in 2011. Lower operating profit compared to the last year and higher interest expenses were among the key factors contributing to the full year profit performance.

Industrial Pumps Business Unit

The industrial pumps business unit designs, engineers, manufactures and supplies a diverse range of pumps and integrated solutions to customers in the oil and gas, power generation and water utility sectors in Russia, the CIS and internationally. The business unit’s principal products include ready-made pumps built to standard specifications, customized pumps and integrated solutions. It also provides aftermarket sales, maintenance and repair services and other support for its products.

The industrial pumps business unit demonstrated 9.1% year-on-year external revenue growth in the reporting period, generating RUB 17,066 million. This revenue growth largely stemmed from an ongoing flow of small and medium orders and a number of large-scale projects with major customers mainly in oil transportation, oil refineries and upstream segments.

Generally, sales of pumps for oil industry was flattish in 2012 with 32% year-on-year growth in oil upstream pumps and 16% growth in pumps for oil refineries on the back of 5% year-on-year contraction of revenue from oil transportation industry. HMS also focused on strengthening its market positions on the core pump markets and managed to outperform the average market growth in pumps for oil upstream, while was on par with the market in pumps for oil refineries.

Sales of pumps for power generation applications grew by 43% year-on-year. The growth was driven by modernization and construction of nuclear power plants in Russia. Sales of pumps for nuclear applications surged by 180% driven by the contracts signed in

Sales in the water utilities segment declined by 18% year-on-year, mainly due to revenue contraction both in submersible water-well pumps and pumps for water treatment systems. Sales of household pumps continued to decline on the back of high competition and purchasing power of end consumers.

The industrial pumps business unit’s adjusted EBITDA declined by 2.7% year-on-year to RUB 4,278 million in 2012, compared to RUB 4,399 million in 2011, due to changes in the project mix and lower share of high-margin contracts in revenue. The adjusted EBITDA margin stood at 25.1% in 2012 versus 28.1% in 2011.

Oil and Gas Equipment Business Unit

The oil and gas equipment business unit manufactures and installs modular pumping stations, automated metering equipment, oil, gas and water processing and preparation units and other equipment and systems for use primarily in oil extraction and transportation, as well as for the water utility sector. The unit’s products are equipment packages and systems installed inside a self-contained, free-standing structure which can be transported on trailers and delivered to and installed on the customer’s site as a modular but fully integrated part of the customer’s operations.

External revenues if the segment were up 32.7% year-on-year and totalled RUB 7,828 in 2012, compared to RUB 5,900 in 2011. The increase was primarily driven by the large scale project on Vankor oilfield under which the Group equipped oilfield facilities over the second stage of the project development and consolidation of oil and gas equipment producers acquired in 2011.

Sales of water injection pumping stations and other large technological units increased by 8.3%, as a result of increased sales to large-scale projects, including Rosneft’s Vankor oil field. Sales of automated group metering units (AGMU) and other modular equipment for gas transportation surged by 88% mainly due to government regulations effected last year, requiring oil companies to install metering devises to measure volumes of gas flared.

The unit’s adjusted EBITDA doubled year-on-year to RUB 1,397 million in 2012, compared to RUB 697 million in 2011. The adjusted EBITDA margin was 17.8% in the reporting period, up from 11.8% in 2011.

Compressors Business Units

| Employees | 2.4 ths |

| Contribution to 2012 Group sales | 4% |

| Contribution to 2012 Group EBITDA | 1.4% |

The compressors business segment designs, engineers, manufactures and supplies a diverse range of compressors and compressor-based solutions, including compressor units and compressor stations, to customers in the oil and gas, metals and mining and other basic industries in Russia. The business segment’s principal products include customized compressors, series-produced compressors built to standard specifications, compressor-based integrated solutions.

In July 2012, HMS acquired KazanKompressorMash (KKM), one of the leading compressor producers in Russia, which was consolidated into the IFRS reporting of the Group starting from July 01, 2012. Previously, KKM didn’t apply IFRS accounting principles for its financial reporting that makes it irrelevant to provide year-on-year comparison of the key financial indicators.

HMS applied IFRS accounting principles for KKM reporting starting from the third quarter of 2012 and reports the results under the Compressors business segment.

In the second half of 2012, revenue of the business segment was Rub 1,426 million, EBITDA was Rub 85.6 million. As a result, EBITDA margin stood was 6%.

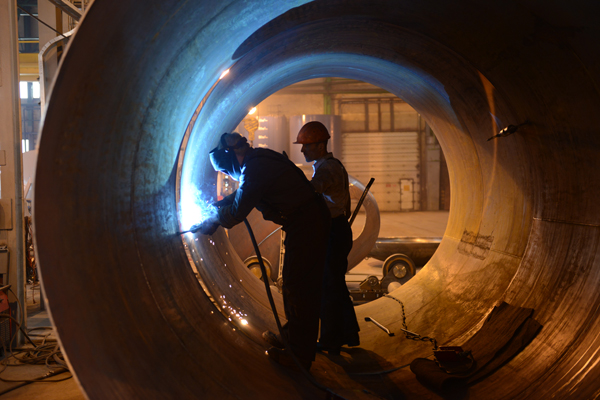

Engineering, Procurement and Construction (EPC) Business Unit

The engineering, procurement and construction (EPC) business unit provides design and engineering services, project management and construction works for projects, including on a turn-key basis, for customers in the upstream oil and gas, oil transportation and water utility sectors.

The EPC’s external revenues grew by 23.4% year-on-year to RUB 7,336 million in 2012, compared to RUB 5,946 million in 2011, mainly driven by contracts for oilfields infrastructure construction.

EBITDA in the EPC business segment contracted by 15.6% year-on-year to Rub 475 million in 2012 with EBITDA margin of 6.5% versus 9.5% in the corresponding period of the previous year. The segment’s margin contraction resulted from the challenges appeared during implementation of the one of the two EPC contracts at Srednebotuobinskoye oilfield. Due to insufficient quality of design documentation under one of the contract, containing a number of uncertainties, the project required additional investments. Over the course of the negotiations with customer, HMS continued to incur expenses related to the project implementation that damaged expected profitability of the project. However, HMS didn’t break off relations with the customer and keeps on successful works under second contract in line with the budgeted performance.

Lower than expected margin in the project and design area has also contributed to the segment’s performance since the Group continued to execute several innovative projects as well as temporarily applied aggressive pricing policy to penetrate new promising market segments. However, the average margin for these projects is expected to be recovered as a result of synergies between the different business segments, as the Group intends to participate in the later stages of these projects.

* ROCE is calculated as EBIT (last twelve months) divided by average total debt plus average equity.